Covid-19 Pandemic

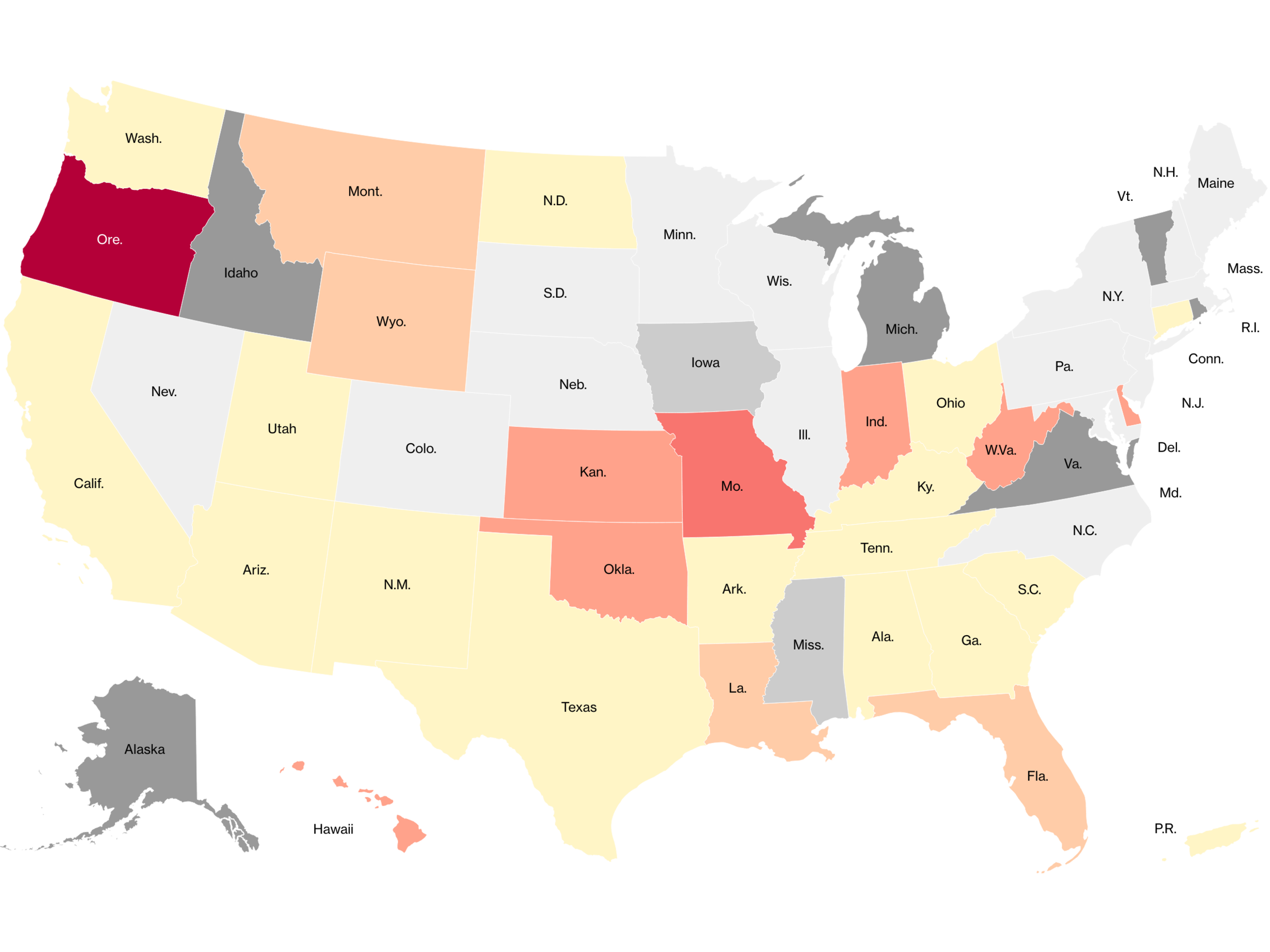

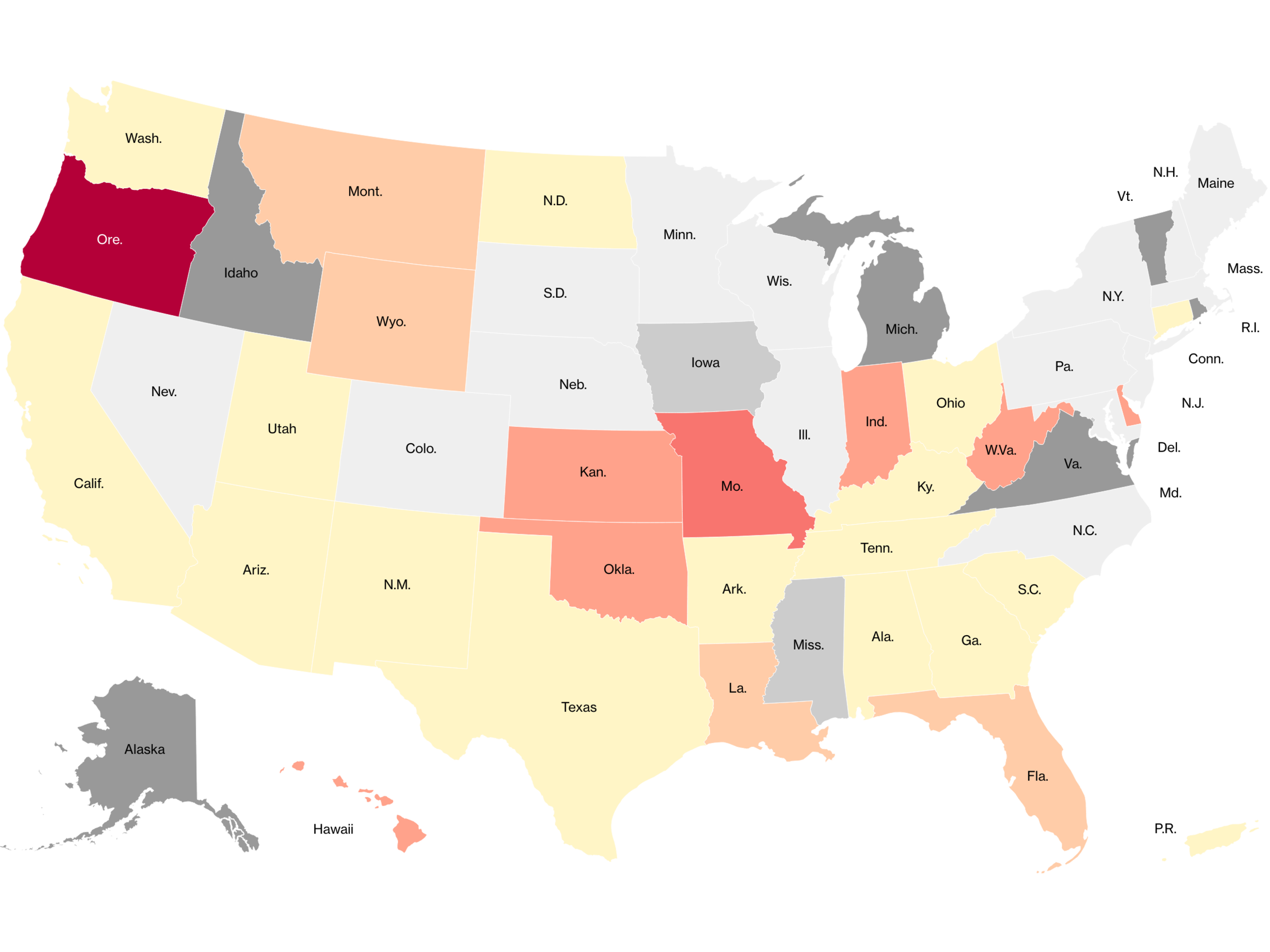

Here’s the latest news: Trump calls coronavirus `kung flu’ and questions count Governments find it easier to provide virus relief than a cureVirus and climate boosts a Japanese maker of air conditioners Housing’s Covid clause Covid-19 has left Britain’s housing market on a path without a map. Here’s the latest news: Trump calls coronavirus `kung flu’ and questions count Governments find it easier to provide virus relief than a cureVirus and climate boosts a Japanese maker of air conditioners Housing’s Covid clause Covid-19 has left Britain’s housing market on a path without a map.Home sales were effectively banned for six weeks when the U.K.’s pandemic lockdown was its tightest, a shock treatment for a country obsessed with home ownership. Since restrictions eased last month, buyers and sellers are trying to diagnose what condition prices are in. Ever the optimists, brokers claim increased inquiries and record clicks on property portals are signs of pent up demand. But cracks are also starting to show. Banks and their home appraisers are getting nervous about prices, leading to a spike in “down valuations,” when lenders value a property at less than the buyer has agreed to pay, according to Andrew Montlake, managing director of mortgage broker Coreco.   Estate agent in Guildford, U.K. Photographer: Luke MacGregor/Bloomberg “We are seeing Covid clauses on some valuations that say, ‘Because of Covid there is less demand for this type of property,'” Montlake said. Estate agent in Guildford, U.K. Photographer: Luke MacGregor/Bloomberg “We are seeing Covid clauses on some valuations that say, ‘Because of Covid there is less demand for this type of property,'” Montlake said.At the same time, the country’s largest mortgage lender, Nationwide Building Society, this week raised buyers’ minimum required deposit. Now more widely adopted, the move is designed to protect lenders from falling prices, but it means loans of up 90% of a property’s value are now very hard to come by. “The outlook for the mortgage market and house prices remains uncertain,” Henry Jordan, Director of Mortgages at Nationwide Building Society, said Tuesday in a statement. “We must factor this uncertainty into our lending assessments.” Meanwhile, home builders smell bargains. Taylor Wimpey Plc raised more than 500 million pounds ($620 million) this week to take advantage of the “significant opportunity’’ to buy cheap land. Rival Berkeley Group Holdings Plc held back 455 million pounds planned for shareholder return, in case it finds deals that are too good to pass up. When the housing market turns, declines in land values are typically larger than the corresponding home price fall because developers build in larger profit margins to protect against further price falls, reducing the amount they can offer. Cheap land acquired in the depths of the global financial crisis helped fuel huge profits for the biggest homebuilders over the past decade as it was developed out when prices recovered strongly. But with unemployment surging again this week and the U.K. government still paying the wages of almost a third of the adult workforce, there may be a lot of pain yet to come before there’s a clear path back to robust housing demand. — Jack Sidders Track the virus U.S. Outbreaks Are on the Rise   New coronavirus outbreaks are beginning to strain health-care systems in states such as Arizona and Texas, and hospitalizations are continuing to increase in Florida and other Sun Belt states. Keep up with the pandemic’s spread in our interactive graphic. What you should read Theater Reopenings Won’t Be Easy Struggling industry can’t afford to get its relaunch wrong. Airlines Suffer a Shaky Start Airlines in Philippines may lose 550,000 jobs this year. Lufthansa Bailout Hangs in the Balance One man could still bring the deal crashing down. Six Staffers at Trump Rally Test Positive for Virus Workers were among hundreds tested and were quarantined. Island That Dodged Virus Now Fears Tourist Influx Visitors from Toronto and Montreal drawn to beaches and vineyards. Know someone else who would like this newsletter? Have them sign up here. Have any questions, concerns, or news tips on Covid-19 news? Get in touch or help us cover the story. Like this newsletter? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Follow Us Get the newsletter You received this message because you are subscribed to Bloomberg’s Coronavirus Daily newsletter. Unsubscribe | Bloomberg.com | Contact Us Bloomberg L.P. 731 Lexington, New York, NY, 10022 New coronavirus outbreaks are beginning to strain health-care systems in states such as Arizona and Texas, and hospitalizations are continuing to increase in Florida and other Sun Belt states. Keep up with the pandemic’s spread in our interactive graphic. What you should read Theater Reopenings Won’t Be Easy Struggling industry can’t afford to get its relaunch wrong. Airlines Suffer a Shaky Start Airlines in Philippines may lose 550,000 jobs this year. Lufthansa Bailout Hangs in the Balance One man could still bring the deal crashing down. Six Staffers at Trump Rally Test Positive for Virus Workers were among hundreds tested and were quarantined. Island That Dodged Virus Now Fears Tourist Influx Visitors from Toronto and Montreal drawn to beaches and vineyards. Know someone else who would like this newsletter? Have them sign up here. Have any questions, concerns, or news tips on Covid-19 news? Get in touch or help us cover the story. Like this newsletter? Subscribe for unlimited access to trusted, data-based journalism in 120 countries around the world and gain expert analysis from exclusive daily newsletters, The Bloomberg Open and The Bloomberg Close. Follow Us Get the newsletter You received this message because you are subscribed to Bloomberg’s Coronavirus Daily newsletter. Unsubscribe | Bloomberg.com | Contact Us Bloomberg L.P. 731 Lexington, New York, NY, 10022 |

PreviousCovid-19 Pandemic